|

Taylor Ranch Uranium Project, Colorado, USA

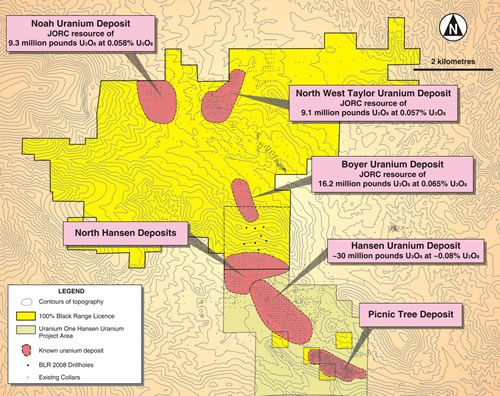

The Taylor Ranch Uranium Project is located approximately 150 kilometres southwest of Denver in Colorado, USA. It lies immediately north of the Hansen uranium deposit in the Tallahassee Creek District of Colorado.

Location of the Taylor Ranch Uranium Project, Colorado, USA.

Since December 2006 Black Range Minerals has secured a 100% interest in more than 9,500 acres at its Taylor Ranch Uranium Project. This area had been relatively poorly explored during the 1970-80’s, but was known to host considerable extensions of the same mineralising system that formed the Hansen deposit.

Since 2006, the Company has conducted extensive drilling programmes allowing it to define JORC compliant indicated and inferred resources of:

39.3Mt at 0.059% U3O8 for 51.1 million pounds of U3O8, or

8.9Mt at 0.12% U3O8 for 23.5 million pounds of U3O8

Previous Exploration

Historic exploration in the Tallahassee Creek District focused primarily on the Hansen deposit but considerable exploration was also undertaken on the surrounding areas now held by Black Range Minerals.

Approximately 1,000 holes had been drilled on the Company’s licences previously, for more than 140,000 metres. Extensive uranium mineralisation had been delineated over more than seven kilometres of strike immediately to the north of the Hansen Deposit, the majority of which is now held under licence by Black Range Minerals.

Six other uranium deposits had been delineated in close proximity to the Hansen deposit, namely the Noah, Northwest Taylor, North Hansen, Northwest Hansen, Picnic Tree and High Park uranium deposits. The Company has secured licences that encompass large proportions of, or all of the mineralisation at these deposits.

The Company has secured a large amount of historic data pertaining to these deposits, including extensive drilling data, metallurgical test work results, reports on mining and feasibility studies, and extensive environmental studies.

Company’s Exploration and Development Activities

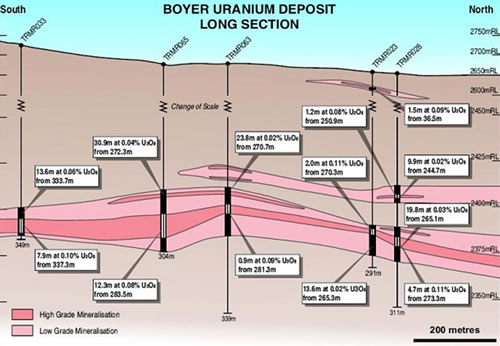

During 2007, the Company completed 70 drillholes for more than 22,000 metres at the Taylor Ranch Project and discovered the large, high grade Boyer Uranium Deposit.

Mineralisation at the Boyer Deposit was still open to the south, so drilling in 2008 focused on the 800 metre long corridor between the Boyer Deposit and the Northwest Hansen Deposit where no holes had been drilled previously. In December 2008, the Company announced confirmation of the presence of high grade mineralisation over the extent of this corridor, with all 6 holes drilled intersecting mineralisation, including:

- 2.4 metres at 0.145% eU3O8

- 2.6 metres at 0.133% eU3O8

- 3.2 metres at 0.121% eU3O8

- 1.5 metres at 0.152% eU3O8

Drilling at the Taylor Ranch Uranium Project, Colorado, USA.

JORC Resources

At various cut-off grades the JORC Code compliant indicated and inferred resource base at the Taylor Ranch Uranium Project comprises:

138.8Mt at 0.027% U3O8 for 83.8 million pounds of U3O81, or

1Applying a cut-off grade of 0.01% U3O8

39.3Mt at 0.059% U3O8 for 51.1 million pounds of U3O82, or

2Applying a cut-off grade of 0.025% U3O8

8.9Mt at 0.12% U3O8 for 23.5 million pounds of U3O83

3Applying a cut-off grade of 0.075% U3O8

Considerable potential remains to expand the resource base with further exploration.

Long section through the Boyer Uranium Deposit.

Consolidation of Ownership within the District

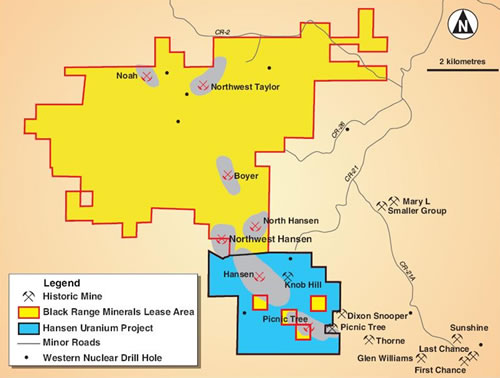

During the December 2008 quarter Black Range Minerals Limited (Black Range) and Uranium One Inc. (Uranium One) executed a letter of intent, agreeing to jointly pursue the development of their uranium projects in the Tallahassee Creek District of Colorado.

Uranium One currently holds an option to acquire a 39.2% interest in the Hansen Uranium Project. This project is located immediately south of, and adjacent to, Black Range’s Taylor Ranch Uranium Project. The owners of the surface rights to the Hansen Project currently hold a 51% interest in the mineral rights in the same area. These landholders recently declared their 51% mineral interest in the project is for sale.

Black Range and Uranium One have executed a letter of intent, agreeing to jointly pursue the acquisition of this 51% mineral interest. Provided such 51% interest is acquired by December 19, 2011, the two companies will consolidate their assets in the Tallahassee Creek district and establish a joint venture.

It is intended that Uranium One shall hold a 60% participating interest in the joint venture and Black Range shall hold a 40% participating interest.

The Hansen Project hosts a series of uranium deposits within the same mineralized trend that hosts the deposits within the Taylor Ranch Project, and includes the North Hansen, Hansen and Picnic Tree uranium deposits. The Hansen Uranium Deposit is the largest of all of the uranium deposits within the mineralized trend (including those in the Taylor Ranch Project).

The Hansen Uranium Deposit was discovered in 1977. It immediately became the focus of a concerted exploration programme by previous owners that led to the definition of approximately 30 million pounds of mineable U3O8 at a grade of ~0.08% U3O8. A previous owner completed a positive bankable feasibility study on the Hansen deposit in the early 1980’s and all permits were in place to commence open cut and underground mining and to construct an on-site processing facility. However the global uranium price collapsed prior to commencement of construction and until recently no further work was undertaken.

By consolidating the ownership of key mineral rights within the Tallahassee Creek district the owners of the project would hold combined mineralization in excess of 100 million pounds of U3O8. A large proportion of the Hansen Project has been drilled out by previous owners to sufficient detail for it to be included in a bankable feasibility study. This mineralization base should have the grade and “critical mass” required to attract the capital that will be required to develop the project in future. Any such development could be optimized for the area, which should ultimately result in reduced operating costs.

|